An IRS Letter Is Not the End of the World -- Unless You Ignore It

For tax payers, few things can cause a spike in in your blood pressure faster than receiving a letter from the Internal Revenue Service (IRS). But before you go into a doom spiral imagining all of the worst-case scenarios, it is important to take a step back and understand what an IRS notice actually means.

Yes, the IRS has the authority to assess taxes, impose penalties, and even in extreme cases, seize assets. More often than not, it is a routine matter that can be resolved without much trouble as long as it is handled properly.

Read More

The Double Tax Benefit of Gifting Appreciated Stocks to Charity Instead of Cash

Every December, Americans scramble to find last-minute ways to lower their tax bills. And one of the most common strategies—particularly among high-income earners—is to make charitable donations often by writing a check to support their favorite cause.

While cash contributions are simple and straightforward, they are not always the most tax-efficient way to give. For those who own stocks that may have appreciated significantly from when they were purchased, donating shares instead of cash can provide a double tax benefit. In this instance, the donor not only avoids capital gains taxes on the appreciation but also receives a deduction for the stock’s full fair market value.

Read More

Here’s How a “TOD” Designation Can Simplify the Transfer of Your Home to Heirs Without Sacrificing Control

For most Americans, your home is likely your most valuable asset. In fact, for centuries, it has been the greatest source of inter-generational wealth transfer by a wide margin. This explains why many parents weigh the idea of designating their adult children as co-owners on the property's title as an estate planning mechanism.

Unfortunately, most stop short out of fear, and for good reason. Giving up financial control of such an important asset is a scary thought for many seniors. Thus, ensuring a smooth transfer of ownership to heirs while retaining full control during one’s lifetime is a common concern for older homeowners.

Read More

Give Yourself Permission to Spend Your Inheritance

Inheriting money or investment assets from a loved one often brings a complex mix of emotions. On one hand, there’s gratitude and an acknowledgment that someone cared enough about you to leave behind a financial legacy. On the other, there is an unspoken pressure to preserve what was left behind. It’s almost as if spending even a penny or making any changes would somehow dishonor the person’s memory.

This hesitation is especially common with investments such as stocks, mutual funds, and rental real estate. And even when a person inherits an asset that does not make financial sense to hold onto long-term, they feel it would be wrong to sell or adjust what their parent or loved one thoughtfully built over decades.

Read More

Have a Concentrated Stock Position to Unwind? Here's an Approach to Consider.

Workers who climb the ranks within a company for senior- or executive-level positions likely have accumulated a meaningful amount of that company’s stock along the way. With this, deciding whether or not to sell company stock upon retirement can put you at an emotional and financial crossroads.

It is a decision that requires separating professional identity from financial reality—a challenge that can be surprisingly complex. After years of aligning personal successes with the company’s growth, stepping away can feel like losing a part of yourself. Add to that the difficulty of accepting that the "someday" you have envisioned for decades has finally arrived, it's easy to see why many soon-to-be retirees find themselves hesitating when it’s time to turn those paper gains into actual dollars.

Read More

The Value of Making Non-Deductible IRA Contributions

For high-income earners who often find themselves phased out of many tax deductions, the rules around saving for retirement are no better. However, there is one complex yet beneficial maneuver available: non-deductible contributions to a traditional IRA.

While contributions to traditional IRAs are typically appealing because they can be deducted from your taxable income, those with higher earnings may hit income thresholds that disallow this deduction. The opportunity to make non-deductible contributions, though, remains a viable strategy.

Read More

Does Your Portfolio Actually Need Alternative Investments

In the past few years, alternative investments have surged in popularity among retail investors looking to diversify beyond the perceived limitations of traditional stocks and bonds. Once reserved exclusively for the ultra-wealthy and institutional investors, alternative investments—including private equity, real estate, private credit, hedge funds, farmland, and even collectibles like art and wine —are now more accessible than ever.

Today, the appeal of this alternative asset class lies in its potential for outsized returns. However, it was initially intended to provide investors with a hedge against inflation, as well as the promise to reduce a portfolio’s correlation with the stock market, which offers a buffer in times of volatility. Therefore, it is possible that there is a misunderstanding between the banks, brokerages, and other financial institutions offering alternatives to retail investors and the investors who are eagerly embracing them.

Read More

Drafting a Trust Is a Waste of Money if You Don’t Retitle Your Assets Too

A revocable living trust is often seen as the cornerstone of a well-constructed estate plan. It allows individuals to bypass probate, maintain privacy, and when the time comes, it ensures a smoother transfer of assets to beneficiaries. However, many individuals stop short of completing the most critical step: retitling their assets into the name of the trust.

When you establish a revocable living trust, you essentially create a legal entity to hold your assets during your lifetime and to distribute them after your death. For the trust to function as intended, ownership of your assets—such as real estate, bank accounts, and any investment interests—must be transferred into the trust's name. Failing to do so renders the trust an empty shell, leaving those assets outside its purview.

Read More

Here’s Why Fintech is Poised to Rebound in 2025

After a turbulent few years marked by valuation compressions, rising interest rates, and fading investor enthusiasm, 2025 is shaping up to be a comeback year for the fintech sector. Several factors, including an anticipated slate of high-profile initial public offerings (IPOs), a more favorable regulatory and tax environment, and a resurgence in key fintech stocks, suggest that the industry is entering a new phase of growth and innovation.

Fintech, long viewed as a disruptive force in the financial world, is again capturing the attention of investors who are now more optimistic about its potential for profitability and long-term value creation. Investors would be wise to consider how the sector's improving fundamentals, coupled with macroeconomic tailwinds like the anticipated decline in short-term interest rates, have likely created an attractive entry point for long-term growth opportunities.

Read More

The Case for Paying off Your Home Mortgage While Markets Are at All-Time Highs

Out of 252 available trading days in 2024, the S&P 500 Index notched 57 new all-time highs, with the most recent record close at 6,090.27. This record-breaking market performance has left many investors sitting on massive unrealized gains, prompting the question of whether or not now is the time to sell and lock in some of those profits.

While the question itself is obviously straightforward, the answer is not. As markets continue to power higher, it can be challenging to find attractive opportunities to redeploy the cash from a sale. But for investors who have a more moderate to conservative risk tolerance, a possible solution is to pay off their home mortgage using the proceeds from some of those highly appreciated stocks or other investments.

Read More

Investors Are Increasingly Losing Their Life Savings to Scammers Impersonating Financial Advisors Online

The world of personal finance can be an intimidating place to navigate, especially when it comes to entrusting someone with your hard-earned money. While many financial professionals are legitimate, ethical, and focused on helping their clients achieve their financial goals, there is an unfortunate reality: scammers are constantly evolving their tactics to exploit well-meaning, unsuspecting investors.

Recently, fraudsters have gone so far as impersonating legitimate companies and professionals, creating fake websites, social media profiles, and other online presences to lure victims into their traps. Thus, it is up to would-be investors to remain vigilant, verify the authenticity of the professionals they engage with, and pay attention to signs of potential fraud before making financial commitments.

Read More

Your Investment Strategy Must Evolve Once You Reach Financial Independence

For many investors, financial independence is the ultimate goal. It’s the point where your assets generate enough income to cover your living expenses, giving you the freedom to work on your own terms or choose to retire completely.

However, reaching this milestone should also prompt a critical shift in your investment strategy. While the path to financial independence often involves seeking higher returns to accelerate wealth accumulation, continuing to take on too much risk once you've achieved that goal can be detrimental to your long-term financial security.

Read More

The Benefits of Creating a Living Inheritance for Your Heirs

As Baby Boomers continue to enter retirement, following decades of diligent saving and investing, many are finding themselves sitting on a nest egg that is significantly larger than they will realistically need to live on. In fact, according to Fidelity's most recent 401(k) Millionaire study, the number of people with $1 million or more in their 401(k) accounts reached another all-time high.

For many, this creates an opportunity to rethink the traditional approach to inheritance. When most people think about leaving an inheritance to their next generation(s), they imagine passing on assets after they’ve passed away, ensuring their children and grandchildren are financially secure for years to come. While this traditional approach to inheritance has its merits, there is an increasingly popular alternative that offers profound emotional, financial, and practical benefits: a living inheritance.

Read More

The Case for Consolidation Among Cybersecurity Stocks

A recent survey by PwC of nearly 4,000 business and tech executives representing some of the largest global companies suggests that in 2024, 79% of organizations intended to increase their cybersecurity budgets from 2023. The survey also notes that the cost of security breaches, as well as the number of high-dollar breaches, continues to increase. And although cyber attacks are the top concerns cited, only half the organizations surveyed indicate they are ‘very satisfied’ with their technology capabilities in key cybersecurity areas.

If you couple those findings with the U.S. Securities and Exchange Commission’s (SEC) recent rollout of new rules requiring public companies to disclose material cybersecurity incidents to shareholders, you get the business case for why the cybersecurity sector is ripe for both growth and consolidation over the next few years and why investors might want to pay attention.

Read More

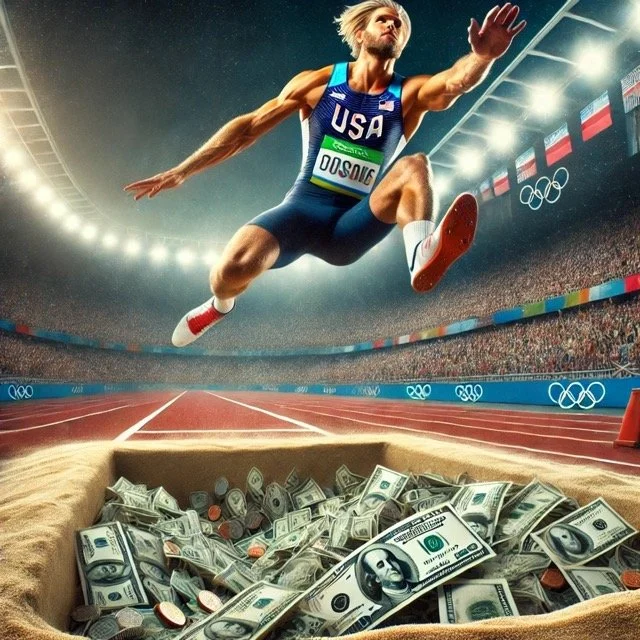

What Can Olympic Athletes Teach Us About Investing?

Every four years, the world gathers to watch the Olympic Games and marvel at the incredible feats of athleticism and the awe-inspiring dedication of the competitors. Whether your favorite event to watch is gymnastics, swimming, or track and field, the athletes who compete all share similar traits that go beyond physical ability, such as discipline, mental toughness, and a willingness to delay gratification.

The success of investing legends like Peter Lynch, author of “One Up on Wall Street,” who achieved remarkable long-term returns during his tenure managing the Fidelity Magellan Fund, underscores the value of patience and persistence. Lynch famously advised investors to "buy what you know" and to stay the course, even during market turbulence. His philosophy is one that mirrors the long-term dedication of Olympic athletes.

Read More

10 Questions to Ask Your Kids About Money

As a parent, teaching your children to become financially responsible is one of the most impactful lessons you can impart. However, knowing what to say, how to say it, and how much information is too much information to share all at once can feel daunting. So much so, that it keeps most parents from ever trying.

In this episode of Malcolm on Money Office Hours, Malcolm shares some questions that parents can use as conversation starters with their children of any age, to help open up lines of communication and get comfortable discussing money as a family.

Read More

How to Avoid the Early Withdrawal Penalty on IRA Distributions

Individual Retirement Accounts (IRAs) are intended to be used as a savings and investment vehicle for retirement. And while it is not uncommon for workers to have a need to tap into this account prior to retirement, if you withdraw funds from your IRA before you reach age 59½, you could owe the IRS a 10% early distribution tax on top of the regular income taxes associated with a distribution from a traditional IRA.

There are, however, a few exceptions to the additional 10% tax. In this episode of Malcolm on Money Office Hours, Malcolm discusses the exceptions to the IRS’s 10% penalty on early withdrawals from IRAs, and shares how to go about claiming such an exception on your tax return.

Read More

You May Be Using Your HSA Wrong

Health Savings Accounts (HSAs) are often referred to as a triple tax-advantaged savings and investment vehicle, due to their ability to allow tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. Yet many Americans do not take full advantage of their potential.

Despite their immense tax advantages, HSAs remain underutilized and mismanaged by a significant portion of those who have them. Oftentimes, HSA owners treat them like a simple checking account to cover immediate medical expenses, failing to recognize their long-term benefits.

In this episode of Malcolm on Money Office Hours, Malcolm shares his take on how to optimize contributions to an HSA, as well as some of the common mistakes HSA participants tend to make and how to avoid them.

Read More

Just Because You Feel Optimistic About Your Company's Stock Doesn't Mean Your Spouse Does

It can often be tempting to accumulate as much stock in your employer as possible- whether as a show of confidence in the future of the company, or as a means to accumulate wealth quickly.But when you decide to join your finances with a spouse or partner, in addition to determining if and how you'll merge your various checking and saving accounts, it's also important to determine how you'll approach investing as a couple.

In this episode of Malcolm on Money Office Hours, Malcolm makes the case for why it's important to take some chips off the table along the way, as well as use the shares that you've accumulated as part of your total compensation package to achieve some of your bigger financial goals. While there's no problem with maintaining a position in your company's stock, you want to make sure that no one security represents more than 20% of your overall net worth at any point.

Read More

What to Consider Before Accepting an Early Retirement Offer

Right now, at this very moment, a growing number of employers are offering some of their more tenured workers large, lump sum payments to turn in their key cards and credentials and retire early.

Especially for those who work in fields like tech, or maybe finance, where companies are currently trying to reduce headcount as a way to show Wall Street they mean business when it comes to controlling costs and exercising some fiscal discipline.

In this episode of Malcolm on Money Office Hours, Malcolm lays out the key things to consider when reviewing an early retirement offer from your employer, as well as how to know whether you are actually ready to accept it.

Read More